[ad_1]

Major NFT collections see increased demand as sales and trading volume soar across several networks.

As the crypto market rallied after a prolonged crypto winter, the non-fungible tokens (NFT) market also hints at a comeback — the trading volume of several major collections recording significant highs after months of steady decline.

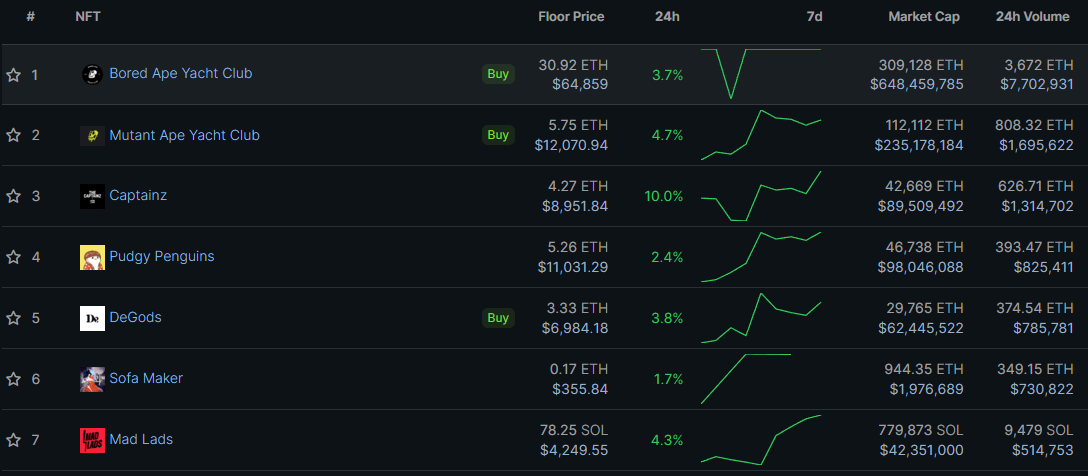

According to the data from Coingecko, the floor prices of the top 15 NFT collections have significantly soared over the last few days, demonstrating increasing demand.

Most notably, the floor price of the Bored Ape Yacht Club (BAYC) collection has increased over 70% in a month, from $24.8 in the first week of October to $30.90 on Nov. 13. BAYC’s 24-hour trading volume has also risen by 51% today, showcasing increased trading across marketplaces.

The 24-hour trading volume of Captainz, a popular collection from Memeland, soared by over 680% since yesterday.

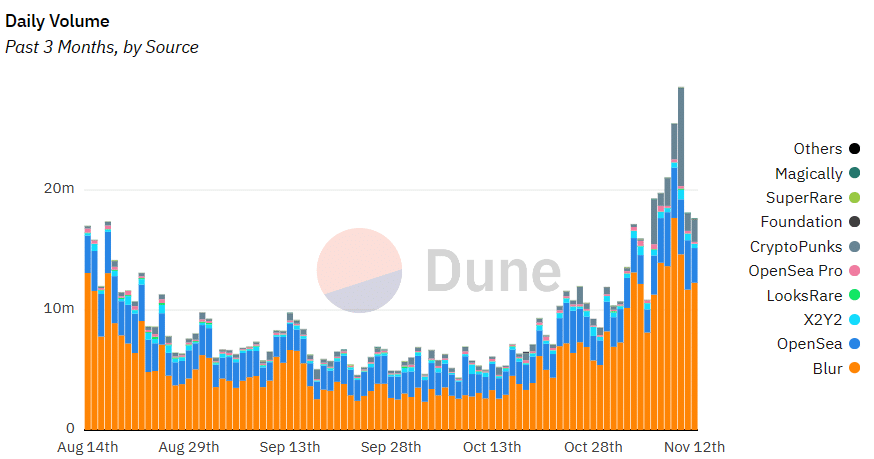

Data from Dune Analytics show that NFT trading volume across major marketplaces in November recorded the highest figures since July. On Nov. 10, daily trading volume reached a four-month high, with Blur accounting for the lion’s share of the trades.

In terms of sales volume, CryptoPunks led the way with a 373% increase in weekly sales. BAYC also recorded a 42% increase in sales.

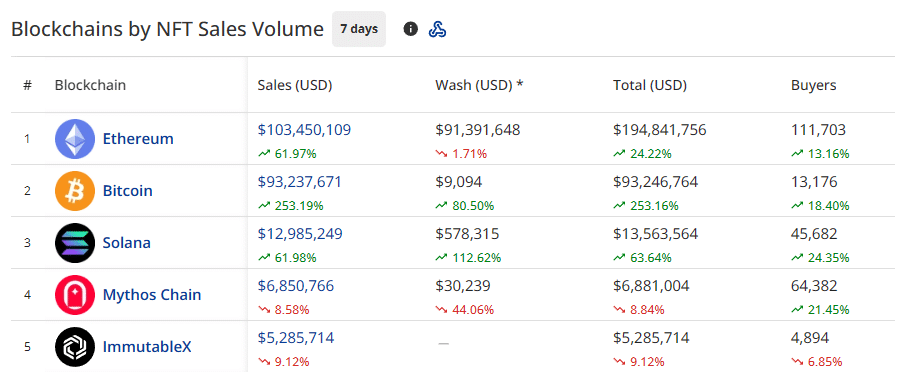

Overall, weekly NFT sales increased by over 60% on Ethereum (ETH) and Solana (SOL) networks. Bitcoin’s BRC-20 collections also saw increased demand, with $SATS and $RATS making notable sales over the week.

The rising sales and trading volumes suggest a positive Q4 for the NFT market, with increased demand across all major marketplaces. However, the non-fungible tokens market is still a mere shadow of its 2021 peak. If the positive sentiment continues to sustain over the new year, we might see the overall market revive to some extent.

[ad_2]