Aster value trades above $1 help as open curiosity climbs. Rising dealer exercise suggests volatility may improve because the market eyes a transfer towards $1.28.

Abstract

- Aster holds key help at $0.93–$1.00 area with bullish confluence.

- Open curiosity rising, hinting at elevated market volatility.

- Holding above $1 may result in a rally towards $1.28 resistance.

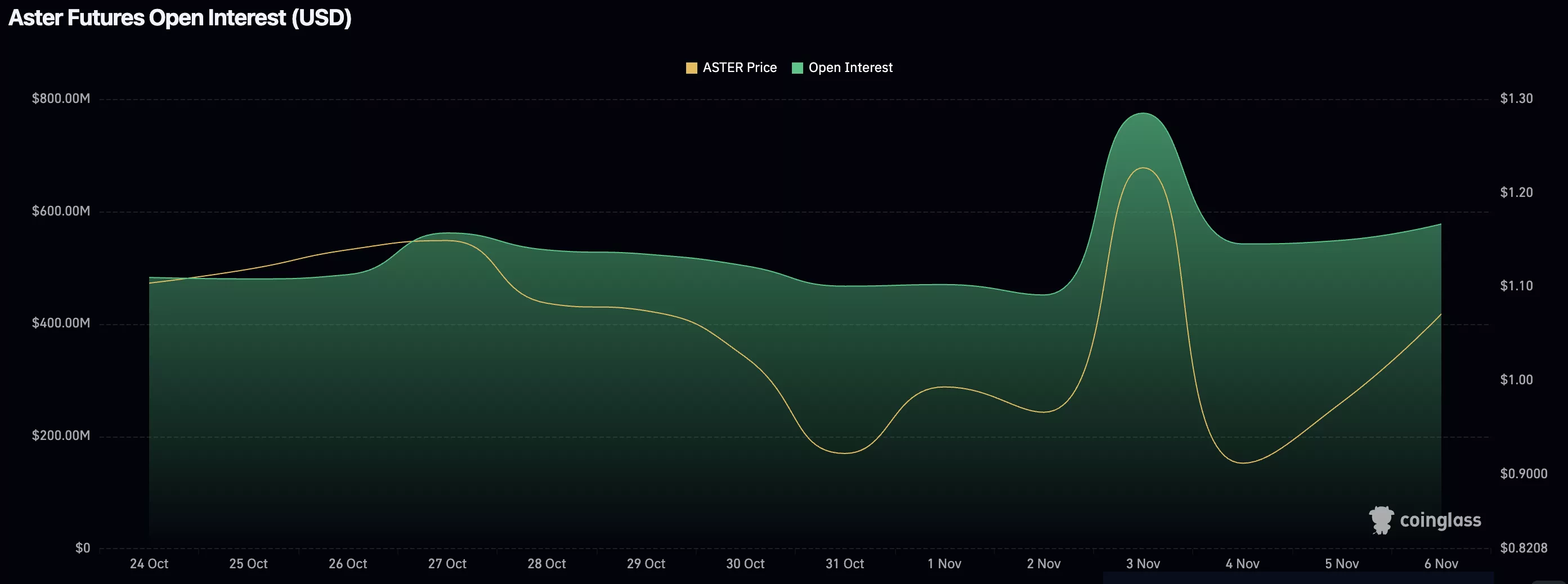

Aster (ASTER) value has held above the $1 psychological degree following current volatility, signaling early indicators of stabilization in a vital technical zone. On the similar time, futures open curiosity has begun climbing, a sign that merchants are more and more lively and positioning for a possible breakout.

With each technical and derivatives knowledge aligning, the approaching days may deliver a notable uptick in volatility for Aster’s value motion.

Aster value key technical factors:

- Main Help: $0.93 area — features a bullish order block and 0.618 Fibonacci degree.

- Resistance Goal: $1.28 swing excessive — key degree for bullish continuation.

- Market Indicator: Rising open curiosity indicators renewed dealer participation.

From a technical standpoint, Aster is buying and selling inside a key help area between $0.93 and $1.00, an space that mixes a number of main confluences, together with the 0.618 Fibonacci retracement and a bullish order block from prior value motion. This construction offers a robust basis for a possible reversal, offered that day by day candles proceed to shut above the $0.93 help zone.

The $1 mark additionally acts as a important psychological barrier, making it a significant value level for each merchants and long-term buyers. If Aster maintains its footing above this space, it opens the likelihood of a rotation towards the following important resistance at $1.28, the earlier swing excessive that capped current rallies.

On the spinoff facet, the current uptick in futures open curiosity displays an rising variety of merchants getting into the market, usually a precursor to heightened volatility. Rising open curiosity usually indicators contemporary capital flowing into positions, on this case, with a bullish bias, suggesting renewed optimism round Aster’s value outlook.

Whereas this will amplify upside potential, it additionally will increase the chance of bigger swings as leveraged positions accumulate. If Aster loses its $0.93 help, liquidation pressures may set off a fast correction. Nevertheless, so long as value holds above this area, momentum seems to favor the bulls within the quick time period.

What to anticipate within the coming value motion

Aster stays positioned at a key inflection level. Holding above the $1 help zone may set off a transfer towards $1.28 resistance, whereas continued progress in open curiosity helps the case for a risky breakout section. Conversely, a day by day shut beneath $0.93 would invalidate this bullish outlook and improve draw back threat.