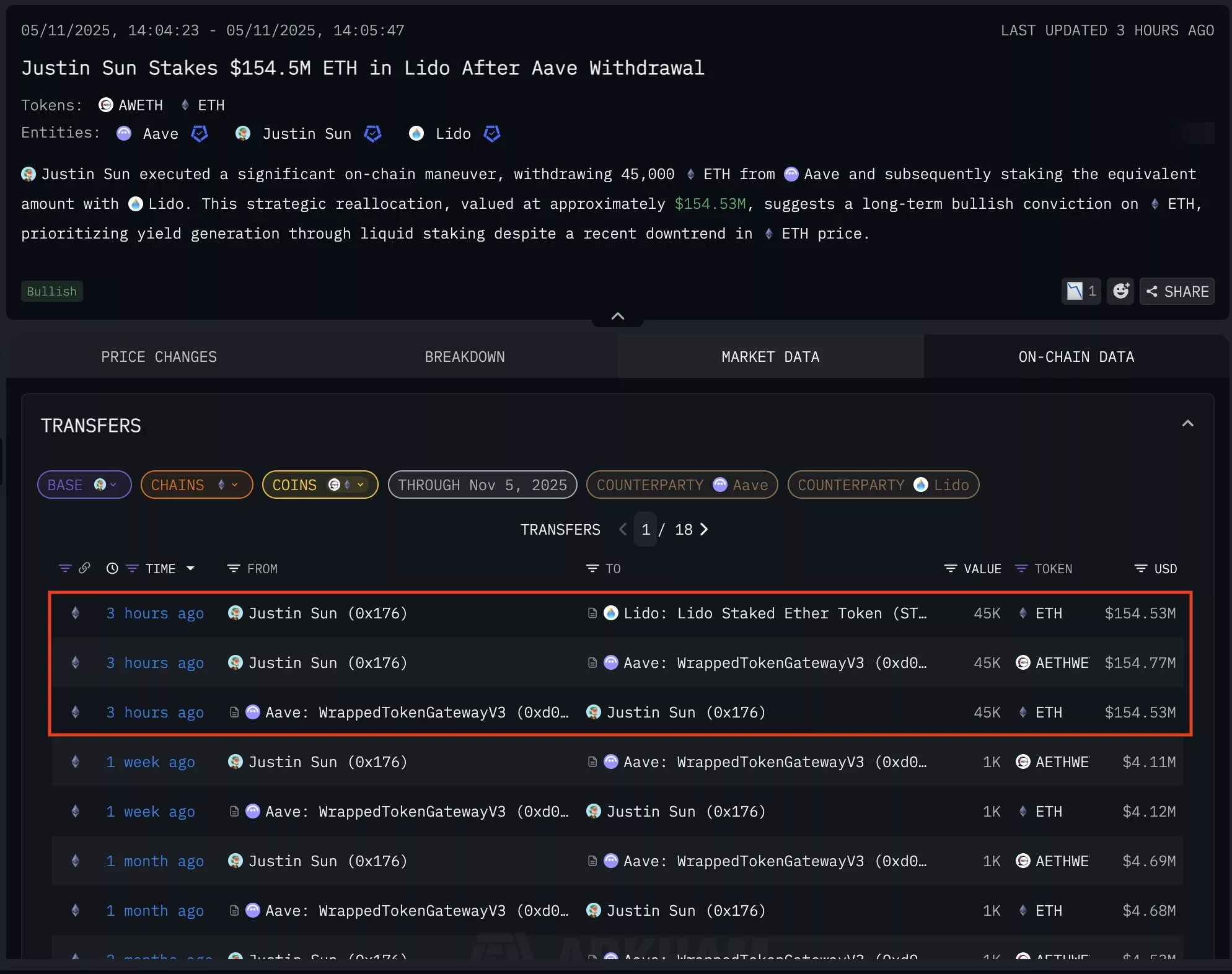

Tron founder Justin Solar has withdrawn 45,000 ETH from AAVE and deposited them into Lido for staking. On the time, his public pockets held extra ETH than TRX.

Abstract

- Justin Solar’s current staking of $154.5 million has sparked bullish sentiment amongst merchants in addition to a shift away from lending and towards staking ETH.

- Information from Arkham and Nansen reveals a shift in Solar’s pockets construction, with most of his holdings saved in staked ETH, TRX and different tokens. The transfer indicated that the pockets could also be going by means of inside restructuring.

Based on on-chain monitoring platform Arkham, the Tron founder has staked as a lot as $154.5 million price of Ethereum from the AAVE blockchain on Nov. 6. Solar then deposited the ETH into Lido for staking, within the type of a Staked Ether Token contract or STETH.

By withdrawing and re-depositing his Ethereum (ETH) into AWETH and again into AAVE (AAVE), the platform’s AI Agent surmised that the transaction could also be half of a bigger try and internally restructure the pockets’s holdings.

After the transaction, Solar’s holdings on his public pockets confirmed that the Tron founder briefly held extra Ethereum than his personal protocol’s native token. On the time, his ETH holdings amounted to $534 million in worth whereas his TRX (TRX) holdings have been valued at $519 million.

Based on information from Nansen, Solar’s public pockets at the moment has crypto holdings price $2.57 billion mixed. After the transaction, his holdings have been reorganized, with most of his wealth saved in TRX as an alternative of ETH. On Nov. 6, Solar’s public pockets holds 2.4 billion TRX or equal to $702.2 million.

In the meantime, Staked Ethereum (STETH) represents about $483.7 million of his holdings. One other $400 million is saved in USDT (USDT), whereas the remainder of his holdings are divided amongst AETHWETH, STRX, STEAKUSDC, AETHUSDT, WLFI (WLFI) and different tokens.

Is Justin Solar going bullish on ETH?

Many merchants beneath the feedback part of Arkham Intelligence identified what Justin Solar’s resolution to stake ETH by means of Lido (LDO) may imply for the outlook of the token. Some have been fast to level out how typically the Tron founder invests in ETH.

“Justin is extra ETH pilled than ETH basis,” stated one dealer.

“Man’s treating $ETH prefer it’s a financial savings account now, staking 45k ETH prefer it’s spare change within the sofa cushions,” stated one other person within the feedback part.

“Justin Solar staking 45k eth in Lido? Bullish sign for ETH long run,” wrote one other dealer.

Arkham’s AI agent, which scans by means of on-chain transactions inside its monitoring system, identified that the transfer may signify “long-term bullish outlook on ETH.”

“The choice to earn staking rewards quite than promoting, significantly throughout a interval the place ETH had skilled a notable worth decline from $4.1k to roughly $3.4k within the continuing week, underscores a conviction in ETH’s future efficiency and the worth of yield technology,” stated the platform’s AI-driven evaluation.

At press time, ETH has slipped additional down from the $3,400 threshold. Regardless of rising barely by 2.24% throughout the previous day of buying and selling the token remains to be buying and selling round $3,395. For the previous week, ETH has been on a downward development, declining as a lot as 12.6%.

Again in July, Solar made an analogous transfer when ETH was on the decline. As beforehand reported by crypto.information, Solar’s public pockets moved 50,600 ETH ($181 million) from HTX into Binance. The ETH was redeemed from Aave by the HTX restoration pockets earlier than it was transferred to an HTX scorching pockets and moved into Binance.

On the time, ETH was seeing main whale accumulation which pumped the worth by 20% in a weekly surge.