Ethereum treasury firm SharpLink Gaming has reportedly transferred over $14 million price of ETH to crypto trade OKX forward of its quarterly earnings name due subsequent week.

Abstract

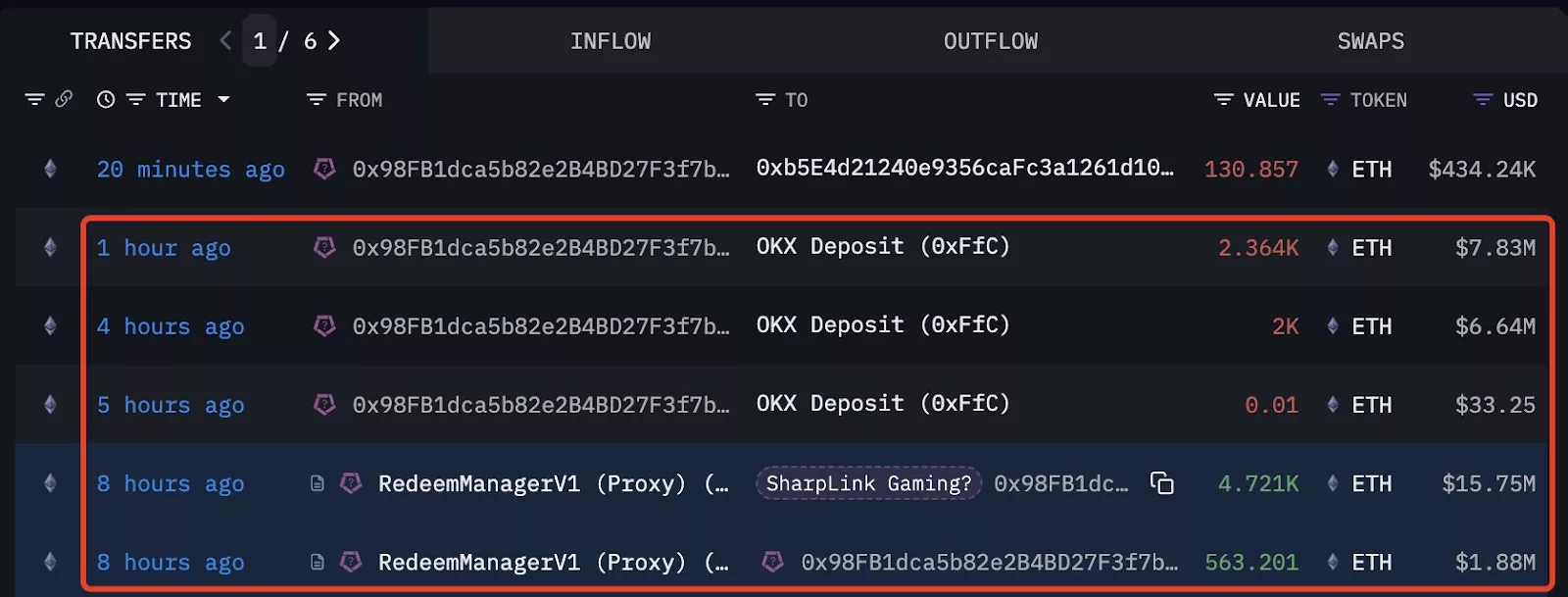

- A pockets linked to SharpLink Gaming transferred 4,364 ETH price 14.47 million {dollars} to crypto trade OKX on Nov. 7.

- The transfer comes days forward of the corporate’s third-quarter earnings name.

- SBET shares are down greater than 12% this week.

A pockets related to SharpLink Gaming transferred a complete of 5,284 ETH and withdrew the property earlier than transferring a portion of the funds, amounting to 4,364 ETH, to OKX on Nov. 7, in accordance with information tracked by on-chain evaluation platform Lookonchain.

Out of the 5,284 ETH withdrawn, 4,364 ETH was despatched to OKX, whereas the remaining steadiness, 791.07 ETH, stays dormant within the recipient pockets as of press time.

On the time of the switch, the worth of the entire withdrawal was roughly 17.52 million {dollars}, out of which round 14.47 million {dollars} price of ETH was directed in direction of OKX.

Massive establishments like SharpLink Gaming don’t sometimes transfer property on this method with out function, however once they do, it’s typically to restructure their treasury allocation or put together to promote, particularly if the funds are being despatched to an trade.

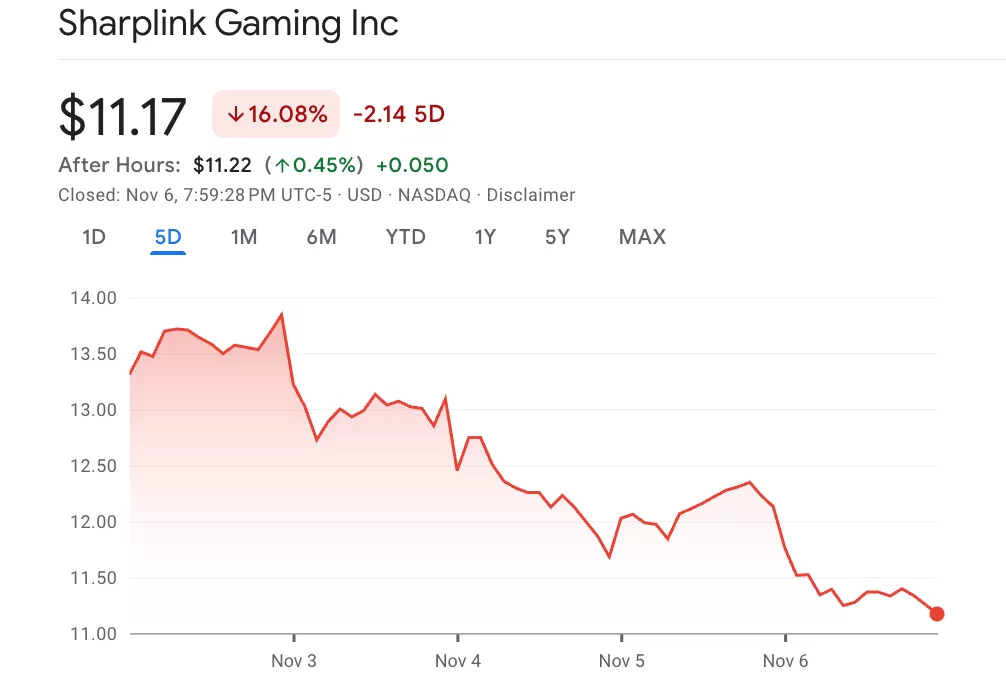

The timing of the switch is notable as SharpLink is about to host its third-quarter earnings name subsequent week, and the corporate’s shares haven’t precisely been holding up in latest classes.

As of Nov. 7, SharpLink Gaming shares, which commerce underneath the ticker SBET, had been down over 8% on the day and have fallen greater than 12% over the previous week. In the meantime, on the month-to-month timeframe, losses are even steeper at over 37%.

SharpLink’s mNAV, which compares its market capitalisation to the worth of its ETH treasury, had slipped to 0.82 on the time of writing, which implies the inventory is buying and selling at a reduction to the property it holds.

Beforehand, the corporate has executed share buy-backs to stabilize its mNAV throughout occasions of market misery, and the latest exercise could also be laying the groundwork for one more such transfer, though SharpLink has not issued any official statements.

It’s not unusual for corporations to shuffle funds or regulate positions forward of earnings calls, both to handle danger or realign publicity in response to market circumstances. SharpLink shares have struggled over the previous month, primarily attributable to Ethereum’s weak efficiency.

Is ETH value in danger?

On the time of writing, Ethereum (ETH) was down almost 25% over the previous 30 days. A lot of this draw back stress on the second-largest cryptocurrency has been exerted by a mix of macro forces that proceed to weigh closely on market sentiment.

Traders are nonetheless digesting the Federal Reserve’s cautious stance on charge cuts, which has helped push Treasury yields larger and strengthened the greenback. On the similar time, commerce tensions between america and China have added one other layer of tension, holding danger urge for food subdued throughout danger markets.

ETH value has been making an attempt to stage a restoration from multi-month lows close to 3,000 {dollars} visited on Nov. 5, however considerations round a possible sell-off from one of many largest Ethereum treasury corporations might introduce contemporary volatility and hamper short-term momentum.