[ad_1]

Ethereum price has been in a steep downtrend for the past few days ahead of the Fed’s two-day monetary policy meeting. The asset has been struggling below the crucial level of $1,900 over the past few days amid a decline in market sentiment. At press time, Ethereum was trading slightly lower at $1,855.

Economic Headwinds

Ethereum price has been under intense pressure for the past few days as the Fed’s two-day policy meeting sparks market jitters. The global crypto market cap has crashed over the last few days to $1.17 trillion, while the total crypto market volume decreased. Bitcoin, the largest cryptocurrency by market cap, has dropped below the critical $30,000 level, buoyed by the weak crypto market sentiment.

A look at the Crypto Fear and Greed Index shows that the confidence among investors about the crypto sector has continued to dwindle. The Index has declined from a Greed level of 63 last week to a neutral level of 52, indicating that most investors are in conservation mode.

The US Treasury yields climbed higher on Tuesday as the Federal Reserve is due to kick off its meeting. The meeting is expected to end on Wednesday when the central bank is expected to announce its interest rate decision. Markets are pricing in a 98.9% chance of the Fed implementing a 25 basis points interest rate hike after its meeting.

Investors will also be watching the guidance by the central bank and comments by the Fed chair, Jerome Powell, hunting for clues about the Fed’s monetary policy path. Additionally, the European Central Bank (ECB), as well as the Bank of Japan, is expected to meet later this week, when the policymakers are expected to announce their interest rate decisions.

Notably, investors will also be on the lookout for several key data points, including the Fed’s favorite inflation gauge, the personal consumption expenditures (PCE) index on Friday. The CB Consumer Confidence Index data for July is also slated to be published later today.

Ethereum Price Analysis

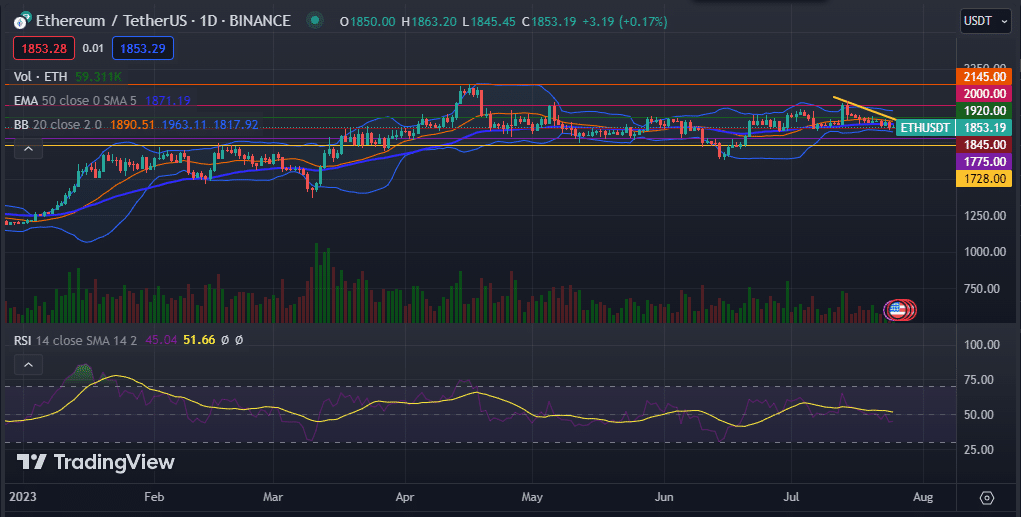

The daily chart shows that the Ethereum price has been on a steep decline for the past few days after facing a strong rejection at the important level of $2,000. During this period, ETH has managed to drop below and remain above the 50-day and 200-day exponential moving averages.

Its Relative Strength Index (RSI) has moved below the neutral line, with the Moving Average Convergence Divergence (MACD) indicator pointing to a sell signal. The Bollinger Bands have narrowed as indicated on the chart, showing a decline in volatility.

As such, the Ethereum price is likely to pull back further in the immediate term as concerns about a hawkish Fed continue to weigh on prices. If this happens, the next support levels to watch will be $1,845 and $1,775. On the other hand, a move past the bullish support level at $1,920 might push the price higher to $2,000, invalidating the bearish thesis.

[ad_2]