[ad_1]

Ethereum price has been hovering around its highest level since May 2023 as investors brace themselves for further interest rate hikes by global central banks this month. Ethereum, the largest altcoin by market cap, has staged a strong recovery in the past few days, jumping by more than 3% in the past week and 64% in the year to date. At the time of writing, ETH was trading at $1,953.70.

Fundamental Analysis

Ethereum price has been hovering above the crucial level of $1,920 for the past few days amid increased bullish sentiment in the crypto market by investors. Bitcoin’s brief make out with the significant $31,000 level has seen the crypto market edge higher. According to Coinmarketcap, the global crypto market cap has increased to $1.21 trillion, with the total crypto market volume jumping by 14.60% over the last day.

The crypto fear and greed index, which measures the current mood within the crypto market, indicates a shift in sentiment in the sector. Over the past few days, the index has improved to a greed level of 61, hinting at a continued bullish market correction.

The sudden interest in the cryptocurrency market by bigwigs such as Fidelity, BlackRock, Cathie Wood, and Charles Schwab buoyed the crypto market in June. Wall Street heavyweights, Charles Schwab, Citadel Securities, and Fidelity launched a crypto exchange platform called EDX Markets. Upon its launch, the high-profile crypto exchange announced the listing of only four digital assets, including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash.

BlackRock recently filed an application for Bitcoin EFT with the US Securities and Exchange Commission (SEC), a move that saw crypto prices jump. However, on Friday, The Wall Street Journal reported that the SEC told Nasdaq and Cboe Global Markets, both of which filed for the Bitcoin exchange-traded funds applications on behalf of various institutions, that the filings were not sufficiently comprehensive. After the report, BlackRock submitted a fresh application for a Bitcoin spot market ETF, which if successful, will be the first Bitcoin spot ETF to win approval.

Focus is now on the global central banks, a week after the Federal Reserve Chair, Jerome Powell, announced that he expects multiple interest rate hikes for the rest of this year. Other banks, including the Bank of Japan, the European Central Bank, and the Bank of England, have also signaled their support for further hikes.

Ethereum Price Outlook

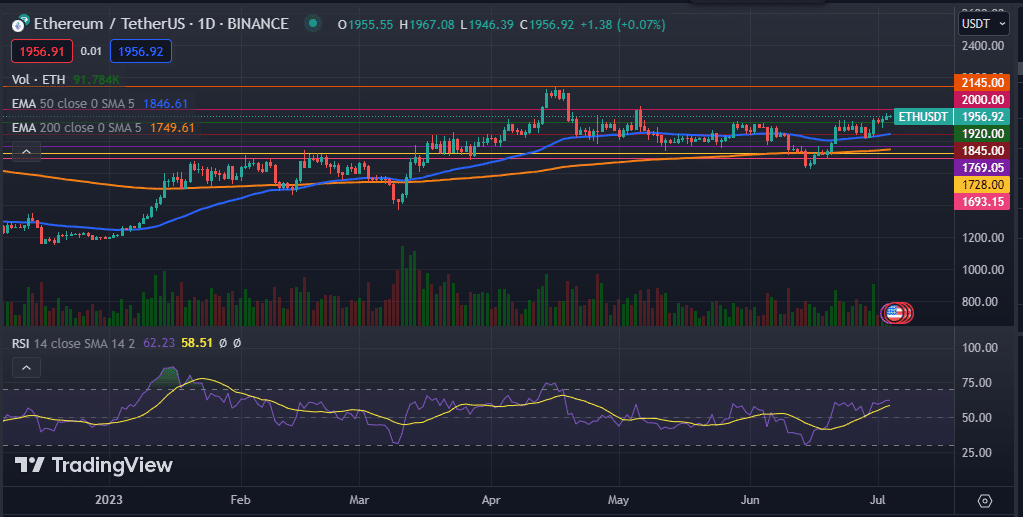

Ethereum price has been holding steady above the key $1,920 level for the past few days as bulls struggle to push the price past the important resistance level of $2,000. The altcoin has managed to move above the 50-day and 200-day exponential moving averages, while its Relative Strength Index (RSI) moves above the neutral zone.

Therefore, despite the macroeconomic headwinds ahead, the Ethereum price is likely to continue rising as buyers target the next resistance at $2,000. On the other hand, a move below the 50-day EMA at $1,920 might push the price lower to find support at $1,845.

[ad_2]