[ad_1]

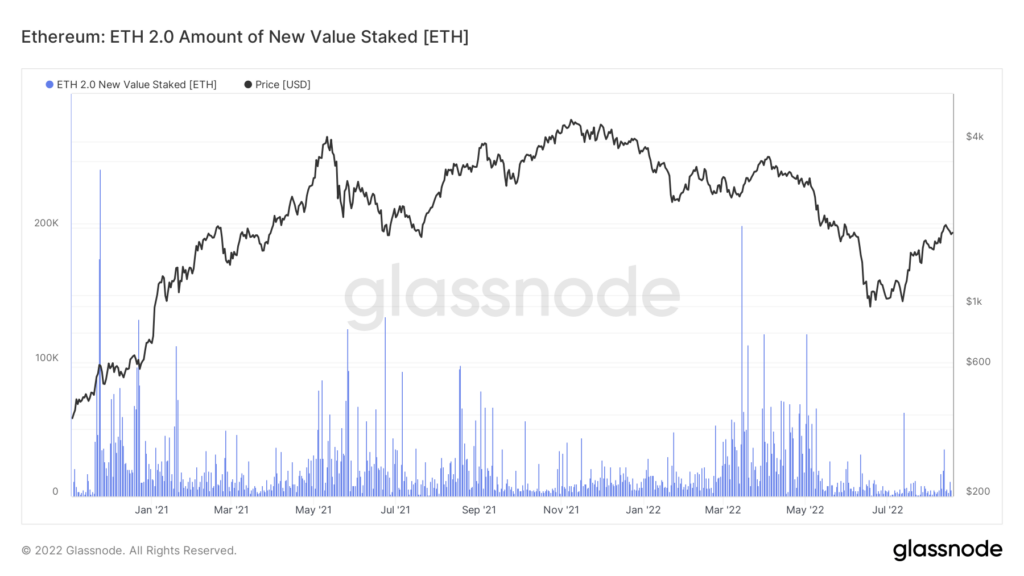

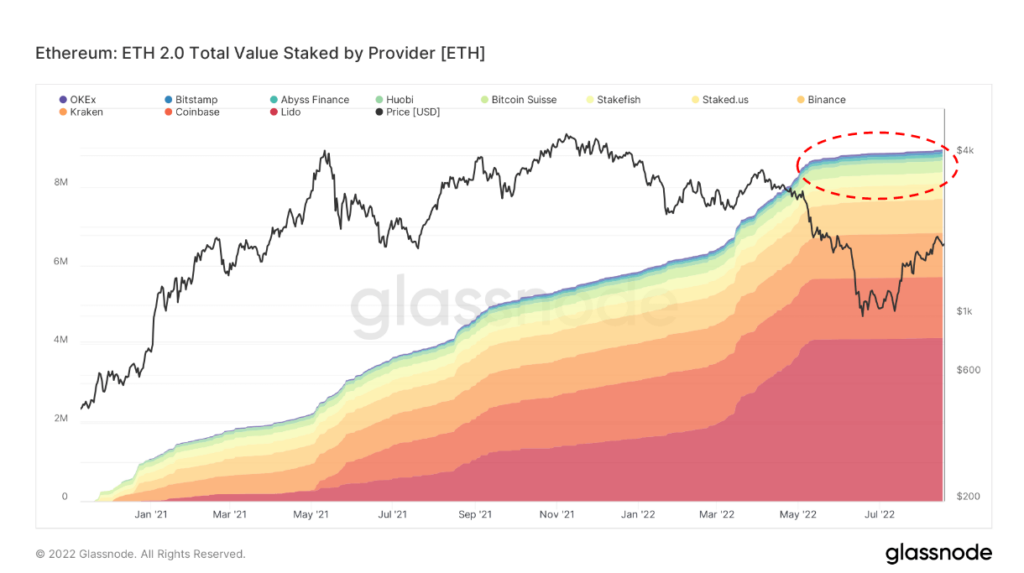

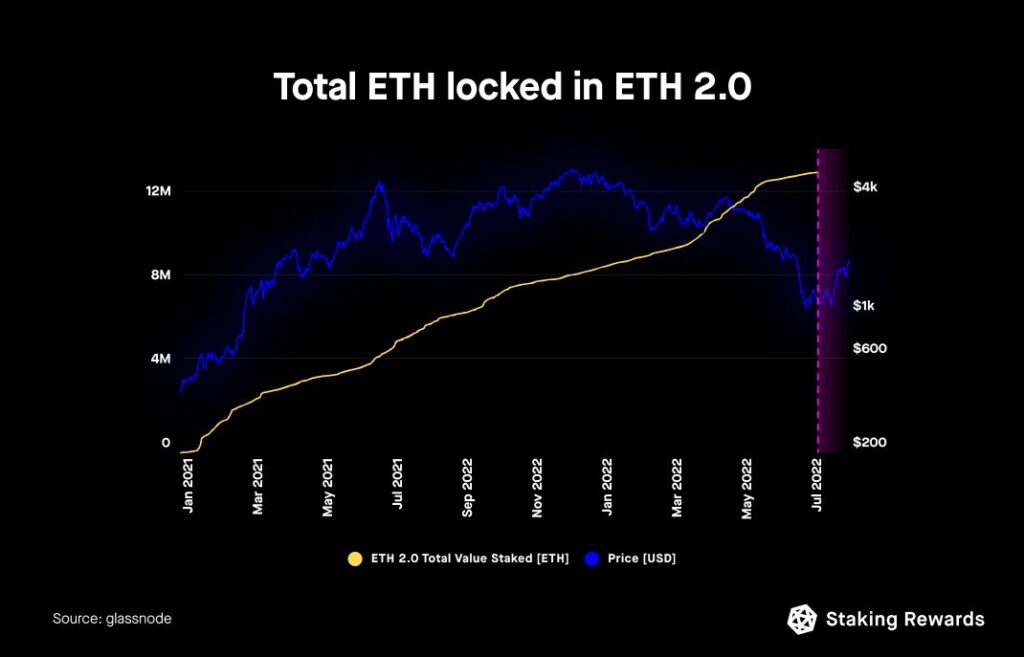

In the midst of an overall decline in the value of DeFi assets, Ethereum staking has been thriving. Despite setbacks and failures within the crypto sector, protocols like Lido and Coinbase’s staking service have seen significant increases in total value locked (TVL). While the TVL of DeFi protocols has dropped to under $38 billion, down from a peak of $178 billion in November 2021, liquid staking protocols like Lido and Coinbase’s service have attracted billions of dollars in assets. This alternative option allows investors to stake their assets and earn yield while maintaining trading liquidity, making it an attractive option in the face of declining DeFi yields and the volatility of the market.

Ethereum Staking Overview

Ethereum staking has been flourishing through protocols like Lido and Coinbase’s staking service even as the value of DeFi assets continues to decline. Over the past year, the crypto sector has experienced a series of setbacks, including failures of centralized crypto exchanges and services, which has also led to capital outflows from the DeFi space.

DeFi Value Shrinkage

According to data from DefiLlama, the total value locked (TVL) within DeFi protocols across various chains now stands at under $38 billion, a significant drop from the industry’s peak in November 2021 when the TVL reached $178 billion. It is worth noting that the current TVL figure falls even below the total value locked shortly after the collapse of centralized exchange FTX in November 2022, which caused a two-year low in the assets locked within DeFi protocols. The market did witness a recovery in April, with the TVL rising back to approximately $50 billion. However, since then, the metric has retraced back to below $38 billion, even though the underlying crypto values have not experienced significant declines during this period.

Liquid Staking Protocols

Meanwhile, the $38 billion figure does not include funds locked in liquid staking protocols like Lido. Since the collapse of FTX, Lido has seen a substantial increase in its TVL from $6 billion to $13.95 billion. According to DeFiLlama, these protocols “deposit into another protocol,” which explains why they are not included in the total TVL tally. Likewise, Coinbase’s staking service, launched in September 2022, has accumulated an additional $2.1 billion worth of Ethereum, bringing the total assets held by such services to $20.2 billion.

Benefits of Liquid Staking

Liquid staking allows investors to stake their assets and earn yield while still enjoying trading liquidity through pegged assets issued by the staking provider, such as cbETH and stETH. This alternative can be more attractive to investors than using lending protocols like Aave, which require users to lock their tokens and potentially expose themselves to unwanted protocol risks. As of now, Aave’s ETH and USDC yield rates are 1.63% and 2.43%, respectively, compared to Coinbase’s more lucrative rates of 3.65% for ETH and 4.5% for USDC.

TVL Decline in DeFi Platforms

The decline in the TVL of several DeFi platforms over the past month is also worth noting. Aave’s TVL has fallen by 21% to $4.5 billion, while Curve Finance has experienced a 26% decline to $2.3 billion. One potential factor contributing to this decline could be the hawkish monetary policy of the United States Federal Reserve. This policy has resulted in higher yields on short-term government debt, making it a more attractive option for investors compared to stablecoin yields within the DeFi space.

Factors Contributing to DeFi Value Shrinkage

The decline in the value of DeFi assets can be attributed to various factors. One factor is the failures of centralized crypto exchanges and services. These failures erode trust and confidence in the broader crypto ecosystem, leading to capital outflows from the DeFi space. Another factor is the hawkish monetary policy of the US Federal Reserve, which has increased yields on short-term government debt and made traditional investment options more attractive to investors.

Ethereum Futures ETFs

In recent news, six asset managers have filed applications with the US Securities and Exchange Commission (SEC) to launch Ethereum futures exchange-traded funds (ETFs). If approved, these ETFs could have a significant impact on the value of Ethereum. ETFs provide investors with an easy way to gain exposure to the price movements of an underlying asset, in this case, Ethereum futures. The approval of Ethereum futures ETFs could attract additional institutional and retail investors to the Ethereum market, potentially driving up demand and impacting the price of Ethereum.

Smart Contract Exploit

A major setback occurred in the Ethereum ecosystem when over 200 Ethereum subscriptions were nabbed due to a smart contract exploit. This incident raised concerns about the security of DeFi platforms and the vulnerability of smart contracts. Smart contracts are an integral part of the Ethereum ecosystem and power many DeFi protocols. The exploit highlighted the need for robust security measures and auditing processes to ensure the safety of user funds and the overall integrity of the DeFi space.

Ethereum Infrastructure Provider Funding

On a positive note, Ethereum infrastructure provider Flashbots recently raised $60 million in Series B funding. This funding round indicates confidence in the Ethereum market and its potential for growth. The funds raised will likely be used to further develop and enhance Ethereum’s infrastructure, which could lead to improved scalability, security, and efficiency of the network. A strong and well-funded infrastructure is crucial for the long-term success and sustainability of Ethereum.

Conclusion

Despite the decline in the value of DeFi assets, Ethereum staking has continued to flourish through protocols like Lido and Coinbase’s staking service. Liquid staking provides investors with an attractive alternative to traditional lending protocols, allowing them to earn yield while enjoying trading liquidity. However, the decline in the value of DeFi assets can be attributed to various factors, including failures of centralized crypto exchanges and services, capital outflows, and the hawkish monetary policy of the US Federal Reserve. The upcoming approval of Ethereum futures ETFs and the recent funding raised by Ethereum infrastructure provider Flashbots could have significant future developments and impact the crypto sector as a whole.

[ad_2]