[ad_1]

Kaiko’s data on October 10 shows that the “Merge” has been a “disaster” for Ethereum’s performance. According to Kaiko, Ethereum has been trailing Bitcoin in price and volume since the critical upgrade was deployed on the first smart contract platform.

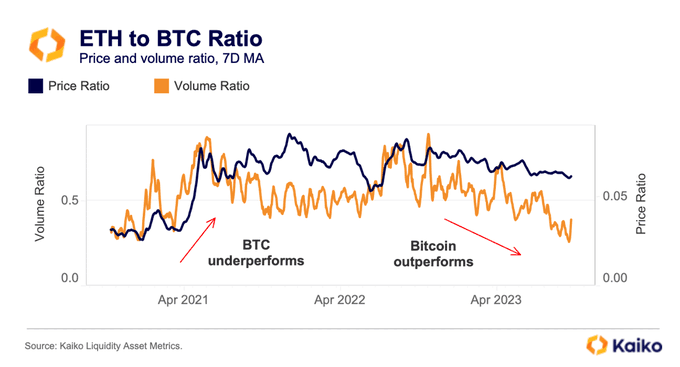

The trend will likely continue, looking at the price and volume ratios of Ethereum and Bitcoin in recent days. A clear divergence shows that Bitcoin could be extending its lead over Ethereum, reinforcing Kaiko’s findings.

The Ethereum Merge: Shift To Proof-of-Stake

Ethereum is now a proof-of-stake network where validators, not miners, confirm transactions and secure it. Before the Merge, Ethereum was a proof-of-work blockchain reliant on miners. In late 2020, Ethereum operated on two networks in parallel, with the current PoS platform, the “Beacon Chain,” being on focus.

On September 15, 2022, Ethereum developers finally switched the proof-of-work legacy chain for the proof-of-stake Beacon Chain, launching the Ethereum 2.0 era. This event was dubbed “The Merge.”

Energy and environmental considerations advised the shift to Ethereum 2.0 and proof-of-stake. By using validators, Ethereum is now more energy efficient, according to some metrics. Besides, developers plan to enhance the network further, scaling it down the line in a series of upgrades or roadmap via the Surge, Verge, Purge, and Splurge.

Bitcoin Is Outperforming ETH Ahead Of Halving

While Ethereum developers are ambitious, Kaiko data shows that Ethereum has been underperforming the world’s most valuable coin, an inversion from the pre-Merge era. Both the price and volume ratios are dropping when ETH is gauged versus Bitcoin (BTC).

The price ratio of ETH and BTC was calculated by dividing the price of ETH with BTC. Meanwhile, the volume ratio is calculated similarly, only that trading volumes are used.

At the spot price ratio, it may suggest that Bitcoin is overvalued versus Ethereum, a bullish formation. On the other hand, dropping the volume ratio may signal that users are opting for Bitcoin over Ethereum. This shift may be due to other secondary and fundamental factors.

The United States Securities and Exchange Commission (SEC) recently approved several Ethereum Futures Exchange-Traded Funds (ETFs). This endorsement means institutional investors can get exposure to complex ETH derivatives, directly boosting the coin’s liquidity.

Considering the volume ratio above, the preference of Bitcoin is ahead of the coin’s halving event, which will make BTC more scarce. At the same time, analysts are raising their odds of the SEC approving the first spot Bitcoin ETFs in the United States, a net bullish for BTC.

Feature image from Canva, chart from TradingView

[ad_2]